- Learn

- Invest

“Saving For College with Bright Start is One of the Best Things We Can Do as Parents”

As their students get closer to their first day of higher education, the Morris family’s college savings contributions are building thanks to Bright Start.

Marlén Cortez Morris and her husband, Sean Morris, have always valued education.

“When my family immigrated to this country, my parents wanted to achieve the American Dream and to provide their children with better education and opportunities than they had,” Marlén said. “I would say they’ve definitely done that, and it opened doors for me.”

Marlén excelled academically and was the first in her family to go to college and continue her education in law school. Today, she is an accomplished attorney. Since his youth, Sean loved sports, and his family upbringing and high school platform ensured college was always in his plans. He worked hard to become a collegiate student-athlete and now works in the financial industry.

To finance their college education, Marlén and Sean applied for and received some financial aid. To offset the remaining costs, which were beyond her parent’s means, Marlén applied to every scholarship she could find and held several jobs, all while maintaining a full course load.

Now, with post-graduate degrees to each of their names, Marlén and Sean hope to give their children the same opportunities at higher education by saving for college with the Bright Start 529 College Savings Plan.

“You can’t rely on scholarships to cover the entire cost of education anymore,” Marlén said. “We are motivated to set our children up for success, and Bright Start will help ease the burden for them in the future.”

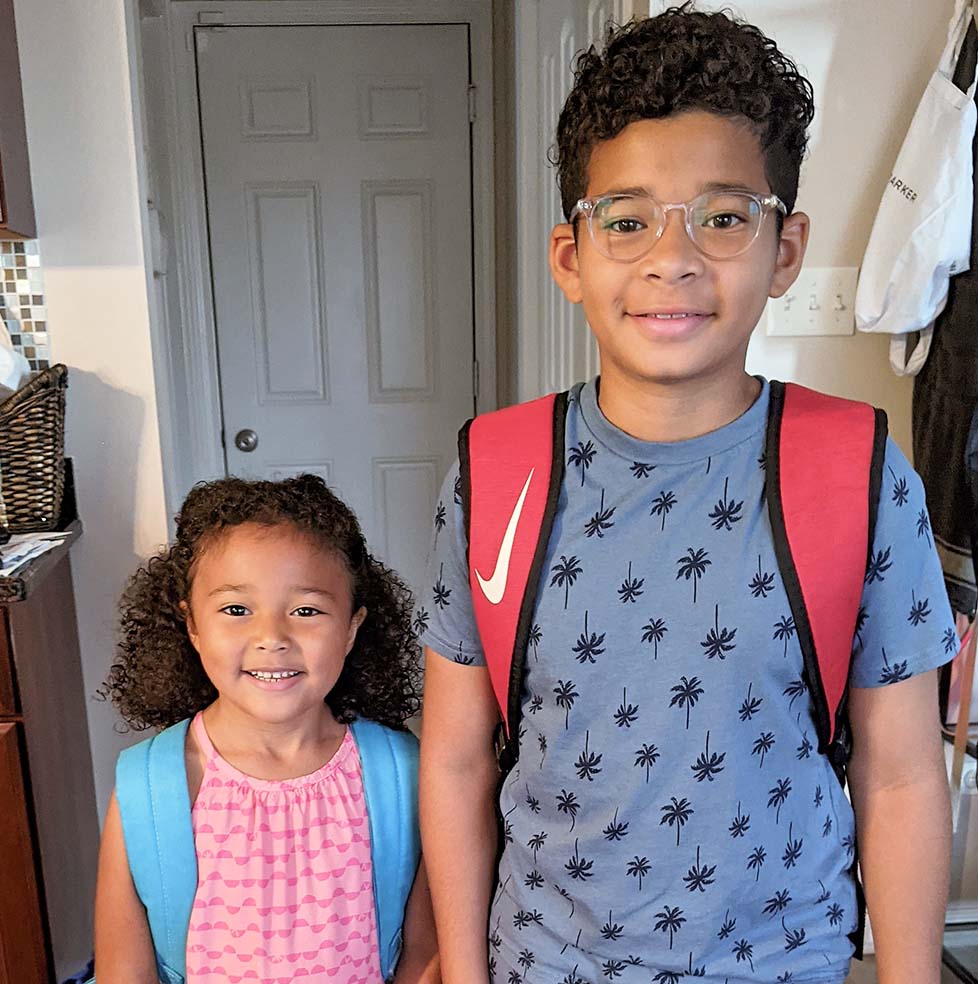

Their children, Andrés, 10, and Isabela, 5, each have their own Bright Start accounts. While the south suburban students ponder what they want to be when they grow up, they do know that they have money invested for college, inspiring them to dream big about becoming a doctor, inventor, CEO, or ballerina.

Saving with a Trusted, Highly Rated Plan

When Andrés was a toddler, the Morris family began saving for college in a traditional savings account, but quickly realized it wasn’t a great way to grow their money. Unlike traditional savings accounts, 529 plans offer tax-deferred growth, which means you do not pay taxes on any earnings or growth in the account while the money is in the plan, as well as the potential for interest on your earnings over time. With that in mind, the Morrises started researching their options and soon noticed a pattern: Bright Start was consistently highly rated.

“We kept coming back to Bright Start given how well it’s performed and its reputation,” Marlén said. “It’s professionally managed, so we can trust that we don’t need to watch it every day. The cost savings are great, and it’s less expensive than other funds we researched. I like that it’s steady, reliable, and has been a solid performer over time.”

Flexible Options for Your Lifestyle

Bright Start offers several quality investment options including age-based, target, and individual fund portfolios to match to your family’s risk tolerance. When the Morrises first opened a Bright Start account for Andrés, they began saving in a very low-risk portfolio. Over time, they were able to easily transition to a new investment strategy that offered the potential for higher reward.

As the account has grown, they have been able to change the amount of their automatic contributions. Each month, a set amount of money is funneled into the Bright Start accounts, giving the Morrises peace of mind. At any time, they can log into the Bright Start portal to see how the accounts are performing and adjust contributions.

“I love the flexibility of Bright Start,” Marlén said. “We plan to buy a house in the near future, so we may need to adjust. But we can still easily update our contribution amounts to feel comfortable and good that we’re going to help ease the financial burden of our kids’ education later on.”

Setting Their Children Up for Success

According to a study from the Center for Social Development, students with money set aside for college savings are three times more likely to attend a post-secondary school. In the Morris household, Marlén and Sean talk to their kids about the importance of a college education, their Bright Start accounts, and let them know that they believe in them to pursue higher education. They have already taken their kids to their respective college reunions and events, exposing them to the vibrancy and excitement of what a college experience can be. While Isabela is a little young to fully understand, Marlén and Sean see how it’s motivating Andrés.

“Our son’s getting excited about the idea that he’s got something in the works and has options for his future,” she said. “It feels really good to set them up for success and to ease the financial cost of education. To make it easier for them is really one of the best things we can do as parents. Even if it’s not the full ride, every little bit helps.”

Start QuoteWe are motivated to set our children up for success, and Bright Start will help ease the burden for them in the future.

End QuoteMarlén Cortez Morris Thinking ahead to what’s down the road, Marlén and Sean are thankful they started saving early, giving their accounts time to compound and grow. As for advice they would give to other families: it’s time to get started by investigating whether a Bright Start account is right for them.

“We have to be prepared and start putting a little money aside,” Marlén said. “Thinking about my community — my Latino community — culturally, we are very family-centric and spend on, for, and with our families. It’s time to also plan for our families’ future financial wellbeing. For my family, Bright Start is empowering our children to pursue higher education.”

Looking for something specific?

Ready to open your account?

Enroll Today