- Learn

- Invest

Tax Center

Understand the tax benefits of 529 plans and find answers to your 529 tax form questions.

Bright Start provides the following:

- IRS Form 1099-Q — issued only when a withdrawal is requested during the year. 1099-Q tax forms will be mailed at the end of January and will also be posted on the Bright Start account portal at that time.

- Contribution Summary — as a courtesy Bright Start provides an annual Contribution Summary. The Contribution Summary is posted online on the Bright Start account portal by mid-February.

To access the above information on the Bright Start site:

- Log into your account

- Once logged in to your account click on the “Statements & Tax Forms” menu

- On this page you will have the ability to select several “Document Types” including:

- “Account Statement”;

- “Contribution Summary”;

- “Tax Forms (1099-Q)”; or

- “Trade Confirmations”.

-

Any year a withdrawal is requested from Bright Start an IRS Form 1099-Q is issued.

- If the account owner received the funds the IRS Form 1099-Q will be issued to the account owner.

- If the beneficiary received the funds or if they were paid directly to the college the IRS Form 1099-Q will be issued to the beneficiary.

Bright Start will mail the IRS Form 1099-Q in late January of the following year and post online at the same time.

-

The prior 529 plan provider will provide you a 1099-Q reporting the amount of the distribution along with a breakdown of basis and earnings. You will want to make sure the basis amount was properly recorded in your Bright Start transaction activity.

-

You will not receive any IRS tax form from Bright Start.

However, you will want to report any large gifts (ie: $10,000 or larger) to your tax professional so they can determine if any special filing is required.

-

If you receive a refund from an Eligible Educational Institution for Qualified Higher Education Expenses that were paid from money withdrawn from your Account, you could:

- Pay Other Qualified Higher Education Expenses – you can use the funds to pay other Qualified Higher Education Expenses incurred by that Beneficiary in the same calendar year.

- Recontribute Refunded Amounts – if a student receives a refund of Qualified Higher Education Expenses that were treated as paid by a 529 distribution, the student can recontribute these amounts into any 529 account for which they are the beneficiary within 60 days after the date of the refund. The amount recontributed cannot exceed the amount of the refund.

You should consult with your financial, tax or other advisor regarding your individual situation.

-

These are expenses related to enrollment or attendance at an eligible postsecondary school. As shown in the following list, to be qualified, some of the expenses must be required by the school and some must be incurred by students who are enrolled at least half-time, defined later.

- The following expenses must be required for enrollment or attendance of a designated beneficiary at an eligible postsecondary school.

- Tuition and fees.

- Books, supplies, and equipment.

- Expenses for special needs services needed by a special needs beneficiary must be incurred in connection with enrollment or attendance at an eligible postsecondary school.

- Expenses for room and board must be incurred by students who are enrolled at least half-time. The expense for room and board qualifies only to the extent that it isn’t more than the greater of the following two amounts.

- The allowance for room and board, as determined by the school, that was included in the cost of attendance (for federal financial aid purposes) for a particular academic period and living arrangement of the student.

- The actual amount charged if the student is residing in housing owned or operated by the school.

You may need to contact the eligible educational institution for qualified room and board costs.

- The purchase of computer or peripheral equipment, computer software, or Internet access and related services, if it’s to be used primarily by the beneficiary during any of the years the beneficiary is enrolled at an eligible postsecondary school. (This doesn’t include expenses for computer software for sports, games, or hobbies unless the software is predominantly educational in nature.)

- The expenses for fees, books, supplies, and equipment required for the designated beneficiary’s participation in an apprenticeship program registered and certified with the Secretary of Labor under section 1 of the National Apprenticeship Act.

- No more than $10,000 paid as principal or interest on qualified student loans of the designated beneficiary or the designated beneficiary’s sibling. A sibling includes a brother, sister, stepbrother, or stepsister. For purposes of the $10,000 limitation, amounts treated as a qualified higher education expense for the loans of a sibling are taken into account for the sibling and not for the designated beneficiary. You can’t deduct as interest on a student loan any amount paid from a distribution of earnings from a QTP after 2018 to the extent the earnings are treated as tax free because they were used to pay student loan interest.

Half-time student. A student is enrolled “at least half-time” if he or she is enrolled for at least half the full-time academic work load for the course of study the student is pursuing, as determined under the standards of the school where the student is enrolled.

Qualified Elementary and Secondary Education Expenses

These are expenses for no more than $10,000 of tuition, incurred by a designated beneficiary, in connection with enrollment or attendance at an eligible elementary or secondary school.

- The following expenses must be required for enrollment or attendance of a designated beneficiary at an eligible postsecondary school.

-

An Illinois Qualified Expense includes all expenses included above under the Federal Qualified Higher Education Expense question EXCEPT for tuition in connection with the Beneficiary’s enrollment or attendance at an elementary or secondary public, private or religious school (ie: K-12).

K-12 expenses are not considered an Illinois Qualified Expense. If a withdrawal is made for such purposes it may be a Federal Qualified Withdrawal and not included in income for federal and Illinois purposes, but if an Illinois income tax deduction was previously claimed for Contributions to the Account all or part of that deduction may be added back to income for Illinois income tax purposes. You should consult with your legal and tax advisors in such circumstances.

-

Bright Start provides an informational “Contribution Summary”. It is posted to your Bright Start account online in the mid-February timeframe. Once logged into your account view “Statements & Tax Forms”.

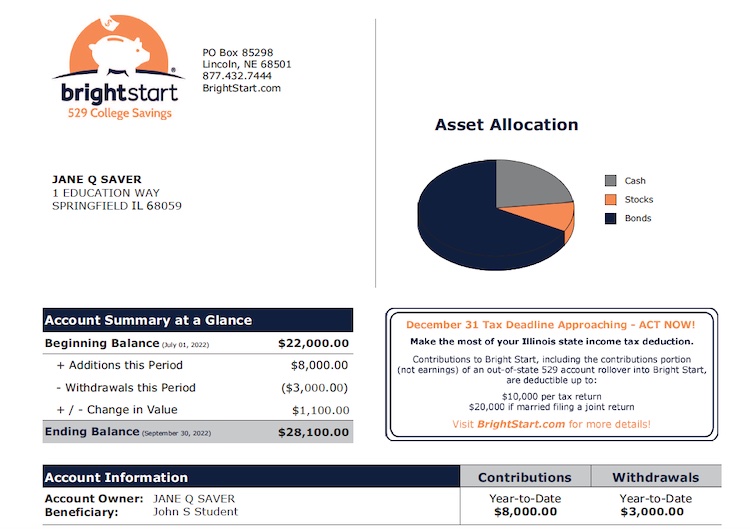

You can also view year-to-date contributions on your December 31 account statement. Year-to-date contributions are included below the pie chart on your statement.

Contributions are reported on a cash basis. If you made any contributions online at the end of December or by mail with a late December postmark you will want to see if they were included in the transaction activity on your December 31st account statement or if they were posted in January as a “Prior Year” contribution.

A contribution must be postmarked to Bright Start no later than December 31st of a tax year (and received by Bright Start on or before January 12).

-

An Illinois taxpayer may deduct contributions made to Bright Start —

- up to $10,000 (individual)

- up to $20,000 if married filing a joint return

The $10,000 (individual) and $20,000 (joint) limitations on deductions will apply to the total contributions made to Bright Start, Bright Directions, and CollegeIllinois.1

-

The Illinois state income tax deduction is available to an individual who contributes to an Account and files an Illinois state income tax return.

-

If you made a gift contribution to a Bright Start account that you do not own, be sure to include the account number, contribution amount, and check the box in column c: gift on Schedule M (IL-1040). If you do not have the account number for a gift contribution, attach a copy of the canceled check and the name and address of the Bright Start account owner.

-

December 31. A contribution must be postmarked to Bright Start no later than December 31st of a tax year.

Contributions addressed to Bright Start and postmarked on or before December 31, will be invested on the day the check is received and if received early in January of the following year will be coded as a “Prior Year Contribution”.

-

If your contributions were made by rolling over funds from another college savings program into Bright Start – the amount of the rollover that constituted investment in the prior qualified tuition program for federal income tax purposes (but not the earnings portion of the rollover) is eligible for the deduction limits discussed above. You should consult your tax or legal advisor about the availability of such deduction.

-

If you’re looking for your 2023 contributions to Bright Start – here are some helpful tips:

-

Review your 4th quarter 2023 Bright Start statement to see year-to-date contributions. On the below statement you will see “Year-to-Date Contributions” below the pie chart. Note – contributions are reported on a cash basis. If you had a contribution in January 2023 that was a “prior year” contribution, make sure to adjust for that along with any contributions made late in 2023 that were received by Bright Start in early 2024. If a third party made contributions to your account they are deductible by the individual making the gift and not the account owner.

- Log in to your Bright Start account online and review your 2023 transactions.

- Once logged in visit “Statements & Tax Forms”

- And Select “Contribution Summary”

- Review your bank account transactions to verify your contributions made to Bright Start in 2023. Contributions postmarked in 2023 are generally eligible for the Illinois state income tax deduction.

- Review the “Bright Start Contributions Summary” that is posted online to accounts mid-February. You’ll locate with your quarterly account statements.

- Rollovers. If you rolled funds to Bright Start from an out-of-state 529 plan — the principal or basis portion (not the earnings portion) is deductible for Illinois state income tax purposes.

-

-

If you took a withdrawal in 2023, whomever the check was payable to — whether it’s the account owner or the beneficiary — will receive IRS Form 1099-Q in the mail (mailed by January 31) or posted online to your account by February 1, 2024. The beneficiary will also receive the 1099-Q for any checks that were payable to the college.

Check with your tax professional for the proper tax reporting.

-

Family and friends can contribute to your Bright Start account. And, gift contributions by a third party are deductible by the contributor for Illinois state income tax purposes. Note: Gift contributions are not deductible by the account owner. The person making the gift contribution may report it on their Illinois 1040 – Schedule M. Check with your tax professional for the proper tax reporting.

-

Individuals that made large gifts to a beneficiary need to review IRS Form 709 for potential filing requirements. Generally, gifts to a beneficiary that total $15,000 or more should be reviewed and may necessitate the need to file IRS Form 709.

View IRS Form 709 and Instructions.

Check with your tax professional.

Internal Revenue Service Circular 230 Notice

Although our professionals provide information about Bright Start, they cannot provide tax advice. The information, including all linked pages and documents, on the Bright Start website is not intended to be tax advice and cannot be used to avoid any tax penalties. Union Bank and Trust, and its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion, including all linked pages and documents, contained on the Bright Start website is not intended or written to be used, and cannot be used, for the purpose of: 1) avoiding any tax penalties that may be imposed under the Internal Revenue Code or applicable state or local tax law provisions; or 2) promoting, marketing, or recommending to any person any transaction or matter addressed herein. You should consult your own tax advisor.

Looking for something specific?

Ready to open your account?

Enroll Today